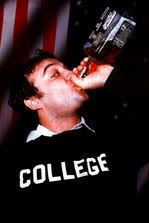

Some insightful advice for graduates

A guest post by vince scordo from Scordo.com

Tweet

Graduating from college is a big adjustment for most students as s/he has to trade-in an insulated, academic, environment for the so-called "real world." The transition from student to working adult is critical, especially in regard to getting your personal finances off on the right foot. The foundation a recent grad lays in the 2-3 years after graduation often predicts how s/he will lead the rest of their economic life. If the recent grad is interested in a flashy new car, eating out, and living in an expensive city, for example, then s/he often delays saving money, paying off student debt, finding the right career, and being financially independent overall.

Here are some practical steps the recent grad can take to ensure that their personal finance life gets off on the right track (after all, you don't want to be worrying about credit card debt by the time you're 25, right?):

1. Begin paying off your student debt as soon as possible. It's tempting to pay the minimum amount each month (especially if you have a low rate), but debt (outside a home mortgage) is a bad thing, so focus first on paying off your student loans (do this at all costs, no one wants to be paying off student debt at the same time they see their first gray hair!).

2. Continue to live with your parents and do not get an apartment. If you're lucky enough to have parents who do not force you out (just because you're over 18) or charge you to live at home, then you've hit the lottery (just think: free food, heat, water, TV, Internet, etc.). Your parents can actually be cool to hang out with (just make sure to have plenty of wine in the house)

3. Do not buy a new car. As I've said before, a new car is a colossal waste of money (whether you are 22 or 60) given that most new vehicles depreciate an average of 45 percent in the first three years! Take the bus or mass transit or look for a bare bones used car that has basic safety feature like stability control, airbags, ABS, etc.

4. Pay for things in cash and if you don't have cash then don't buy it. This tip is really about controlling how you use your credit card. It's ok to have one and use it but be sure to pay off the full balance each month (this will actually help you build a good credit score so that when you go and buy a house you'll get a better mortgage rate and don't have to ask Aunt Peggy for the down payment).

5. Max out your 401K contribution immediately, especially if your company offers a match. There's plenty of data that states that the sooner you start saving the faster your money will compound. And remember that you're saying no to free money if your employer offers a company match!

| 1 | 2 | Next Page